Weekly Forex Analysis and Trade Setups ; March 6-10, 2017

Comments from Yellen and other FED members now put the [mks_highlight color=”#eeee22″]March 15 rate hike on 80 percent[/mks_highlight] probability from 30 percent. NFP data of February 10 would play a major role as FED is waiting for more significant data.

We are bullish on Dollar and expect dollar index would reach 103.50 area sooner.

Let’s look at the trade ideas and their probable setups for this week.

(All charts from FxPro)

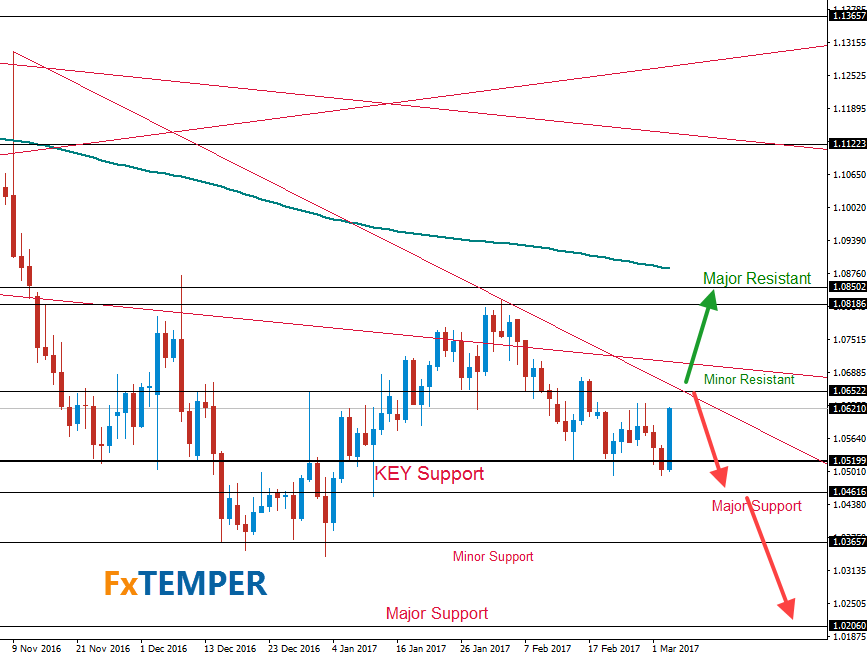

EURUSD:

Temper: Bearish

Much going on lately on Eurozone elections. Any political surprise would make EUR volatile across the board.

And we expect no major changes from ECB at Thursday, though stay cautious during the ECB press conference.

Our view remains same in EURUSD. 1.0652 is serving as resistant and 1.0520 as key resistant.

However, we think it is more logical to short below 1.0461 towards 1.0206 with a minor resistant inside 1.0365 (Low of last Dec 15)

Watch carefully the NFP event, we expect extreme downward move if data published pretty positive.

Reminder, a price break above 1.0652 would push the price towards 1.0850.

GBPUSD:

Temper: Bearish

British pound is bearish for a while. Economic data are not positive for couple of weeks. And there is a fundamental downward pressure as well.

Pound broke 1.23317 and next major support is 1.19858.

However, we will not short in GBPUSD unless it retest 1.23317 area and make it resistant.

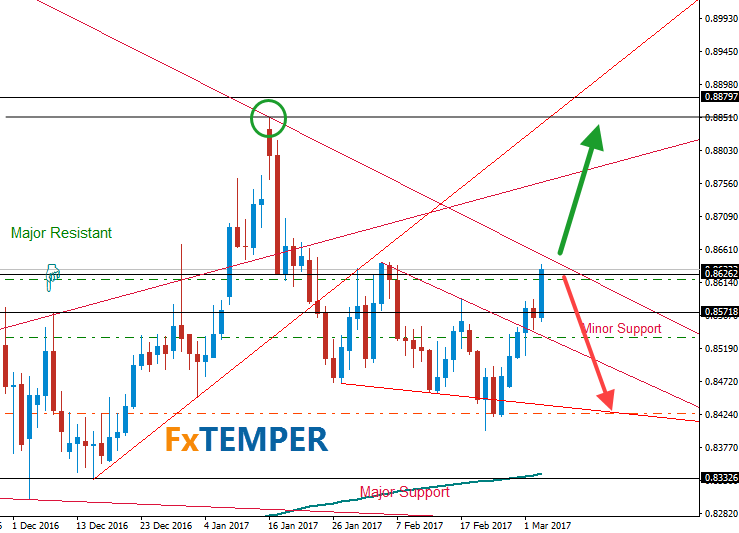

EURGBP:

Temper: Bearish

Price action of EURGBP is interesting. Price broke the .8626 Major resistant but did not the broke the key lower high trend line yet. We want to see the daily closing of the candle of Tuesday too before taking any long position.

However, in EURGBP I put 2 pending sell stop already. But price need to break .8626 first.

AUDUSD:

Temper: Bearish

AUDUSD price moved below the support .76085 last week by an engulfing.

But we expect another revisit of .7700 price area by this week cause lower high trend line (minor) still holding (high of Aug 11 & Sep 8, 2016) though we added small short towards .75036 with tight SL due to the price below of support and will put more positions once break the major support .75036 towards .7310

We expect no major changes but a general dovish tune from RBA at late Monday.

WTI (Oil):

Temper: Bearish

OPEC and Non OPEC members wants another 6 months to add with the original agreement but the situation is seems going to out of control as more members are talking about it. Would the leader Russia do that? Or they will be in some sort of deal with USA? Only time will answer that.

I am running short towards next major support $52. And will add more once break below $52 towards 49.50 area.

Anyway, a break above $55.27 would open door towards another major resistant $58.55

Do you want more analysis? USDJPY, EURJPY, USDCHF, GBPCHF, NZDUSD, EURNZD, GBPNZD, USDCAD, Gold, Silver, SPX500, UK100, Nikkei225 and more. Get them at premium membership area.

Let me know your thought below in comments sections.