Weekly Fundamental and Trade Setups November 21-25

Fundamental:

Aftermath of the victory of Trump in US election makes Dollar strong. Dollar index is record 14 years high. And emerging markets are still facing consequences as Dollar on the key driver role.

There is 95% possibility of much-awaited December rate hike at Dec 14. November 23 FOMC meeting could bring more hawkish as upbeat inflation pressure and trump’s future fiscal policy.

Market expecting an oil production freeze from OPEC meeting in Vienna at November 30. But present situation with Iran, Iraq and Saudi Arabia is more complicated as Trump wins the election. More delay or anything but ‘agreement’ could push the oil lower significantly.

Retails crowed position changed significantly with EUR, JPY, AUD, NZD. Now they net ‘Long’ at EUR,AUD, NZD and Net ‘Short’ at JPY!

FOMC Meeting Minutes and Core Durable Goods order will drive the Dollar and GDP report will drive the GBP.

Technical:

(All Charts are D1 Candle and charts are from FxPro, Your broker could have different price)

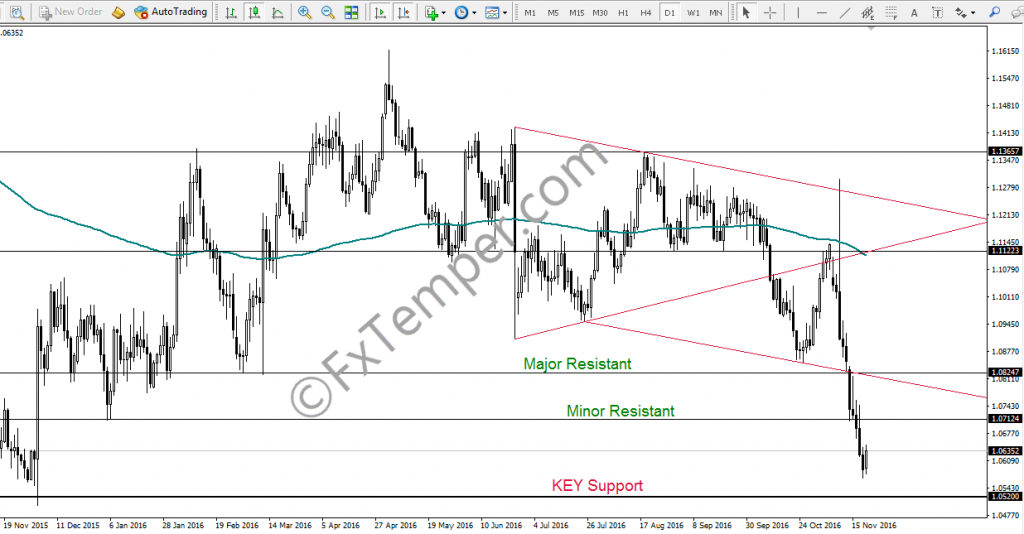

EURUSD:

Temper: Bearish

EURUSD moved lower significantly from a rejection pin bar at November 9 from 1.1122 area and broke previous Major support 1.08247 and minor support 1.07124 next target is the KEY Support 1.0520.

I am already out from my short position at last Friday (Nov. 18). I will be short again if price can break the KEY support by closing reaction.

GBPUSD:

Temper: Neutral

GBPUSD is in Support now 1.2331. We need another bullish reaction at Tuesday to move up to the next Major Resistant 1.2794 or Full potential 1.31188. Or Pound needs to break the present support 1.23317 by Tuesday/Wednesday to meet the Key Support 1.2020 (October flash crash)

GBPJPY:

Temper: Bullish

GBPJPY was the most potential long entry last week and my primary entry still in there. And waiting to hit the Full TP at 138.50 this week. It would be 400+ pips. Check more here.

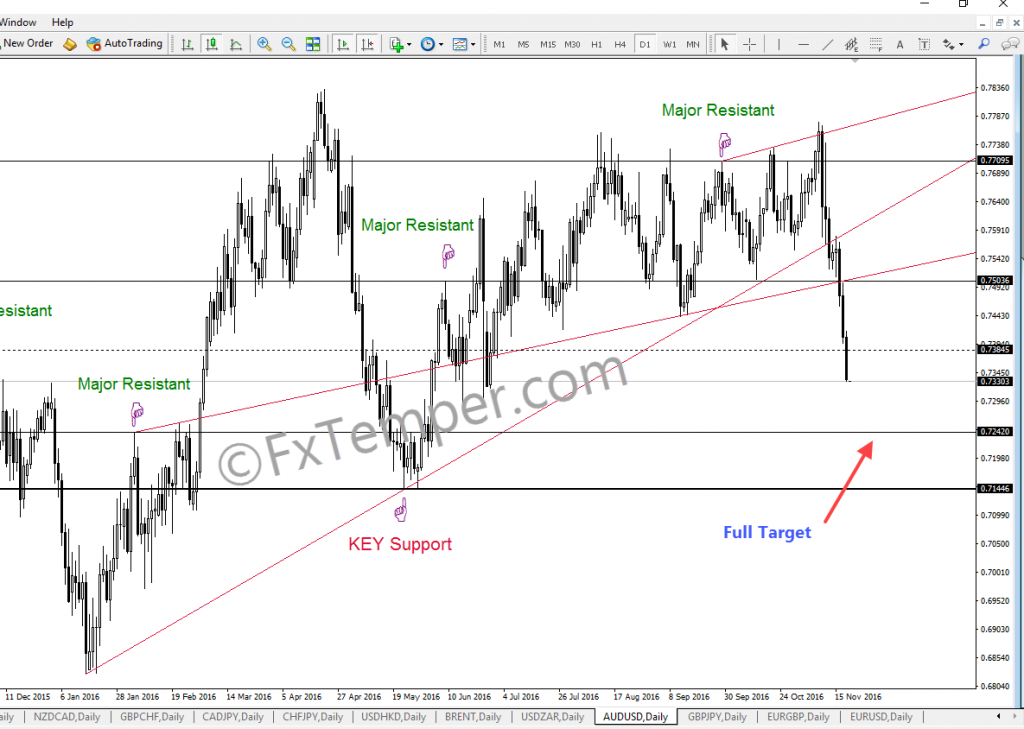

AUDUSD:

Temper: Neutral

My first TP hit at .7385 at Stage 2 but We still need another bearish candle today or Tuesday below .73845 to continue towards .7242.

Do you want more analysis? USDJPY, , USDCHF, NZDUSD, USDCAD, Oil, Gold, Silver, SPX500, UK100, Nikkei225 and more. Get them at premium membership area.