Weekly Fundamental & Trade setups – December 19th to 23rd, 2016

Fundamental:

FED finally hiked 25bp at December 14 and given a pretty good projection for 2017. They are going to hike 3 times at 2017. Though, I am expecting 2 hikes maximum till March 2018. First hike between August and September of 2017 and second one is in the first quarter of 2018.

Donald Trump is going to focus on Jobs and Tax cut which could be positive for USA at 2017. Positive goods order and strong GDP data would make Dollar even more bullish at next week.

OPEC and Non-OPEC members agreed on oil output cut but there is a uncertainty remaining as Mr. Trump is going to withdrawal all the restrictions from energy mining field. So, OPEC and Non-OPEC output deal from January is in a question mark! Oil should see bearish momentum this week.

BOJ is in focus this week. Bearish Yen is giving BOJ berating time. No changes expecting from BOJ at Tuesday but JPY should be volatile during monetary policy statements and Press Conference.

ECB sent EUR to a bearish territory. We should see bearish rally in EUR for longer period of time. On the other hand GBP should be bullish in coming weeks. I am selling EUR against GBP since last 4 weeks. And the view still remains same.

Precious metals should be bearish for longer run as Dollar getting stronger. Commodity and metals co-related currency like AUD and NZD should be bearish for now. CAD needs more positive data to break the USDCAD multiyear higher-low trendline.

Forex market would be less volatile for next few weeks as year-end and we might see some retracement at the beginning of 2017.

Technical:

(All Candles are D1 Candle and charts are from FxPro, your broker might have a little different price)

EURUSD:

Temper: Bearish

ECB and then FED pushed EURUSD below the KEY Support 1.0520 and now EURUSD is under yearly low of 2015 1.04616 which is significant.

However the candle of last Friday is an inside bar So, I will wait for a clear break of the candle of last Friday by D1 closing reaction before new short position towards next Major Support at 1.0206.

GBPUSD:

Temper: Bullish

I was out with my 2nd position from GBPUSD before FED hike at 1.2715 level as it was the only entry which was against the Dollar trend.

I am still bullish at GBPUSD but before holding any new long position I will wait till break the new minor resistant 1.25567 to next major resistant 1.2794 and I will add more long position once break that Major resistant 1.2794 towards the full target 1.31188 which is most important Major Resistant in present Price Action.

EURGBP:

Temper: Bearish

EURGBP is hovering before the non-important lower low trendline. But in past weeks EURGBP made the minor support .82489 less important so I am running my short positions to the full potential .81165 which is the most significant Major Support of present market. However my TP is at .8134

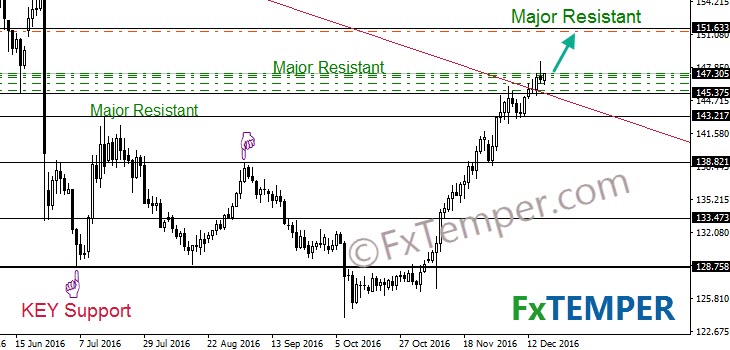

GBPJPY:

Temper: Bullish

After hovering for couple of weeks GBPJPY broke the previous Major Resistant 145.375 (which is acting as Major Support now) at last Tuesday. And opened the door to a 500 Pips long/buy opportunity!

I am holding my long position till next Major Resistant 151.633. However 151.463 is the 38.2% of Weekly Fibbo retracement. So, my TP would be at 151.30.

Important: This is a 2nd category entry so the volume of my long is much lower than a regular entry.

AUDUSD:

Temper: Bearish

During FED hike at Wednesday AUDUSD broke the H4 Major Resistant of the last week .74445 as mentioned last weekly trade setups and hit the TP at .7325 as .73102 was the new minor support.

The full short potential till KEY Support .71446 still remains but before that it must have to break the Major Support .7242 by D1 closing reaction.

Do you want more analysis? USDJPY, EURJPY, USDCHF, GBPCHF, NZDUSD, EURNZD, GBPNZD, USDCAD, WTI (Oil), Gold, Silver, SPX500, UK100, Nikkei225 and more. Get them at premium membership area.