Weekly Fundamental & Trade setups – December 12th to 16th, 2016

Fundamental

Long promising FED 25bp hike is almost certain at Wednesday but other economic policy could be unchanged. FED could send strong message by more aggressive tightening projection at 2017.

On the other hand a year end correction could happen at emerging and safe haven currencies. But It depends on FED.

OPEC and Non OPEC members agrees on oil cut though there are so many questions remain. What would be the role of US in January while Trump administration would be in power? And what would be the role of US shale producers? Oil production is still all time high. Until FED rate Oil should be bullish.

ECB sent the bullish momentum of EUR to the grave. Draghi given even more than market expected!

And anything that is not so negative is positive for Pound. Pound is still bullish and should be until the FED rate hike this week.

Technical:

(All Candles are D1 Candle and charts are from FxPro, your broker might have a little different price)

EURUSD:

Temper: Bearish

EURUSD is hovering between Major Resistant 1.0824 and 1.0520. EURUSD must need to break the KEY Support 1.0520 by closing reaction. A price breakout could open door to short till 1.0206.

GBPUSD:

Temper: Bullish

My 2nd half position is running till 1.2790. GBPUSD made a small bullish channel. A technical break at 1.2794 will open door to 1.3075-1.31 (Higher low trendline after Brexit). But I would be out before FED rate hike.

EURGBP:

Temper: Bearish

EURGBP finally broke the Higher Low trendline and retouch the trendline and made resistant. I am holding shorts again and frist target would be .8255 as .82489 is the First Minor Support and run rest till .8123 as .81165 is the Major Support.

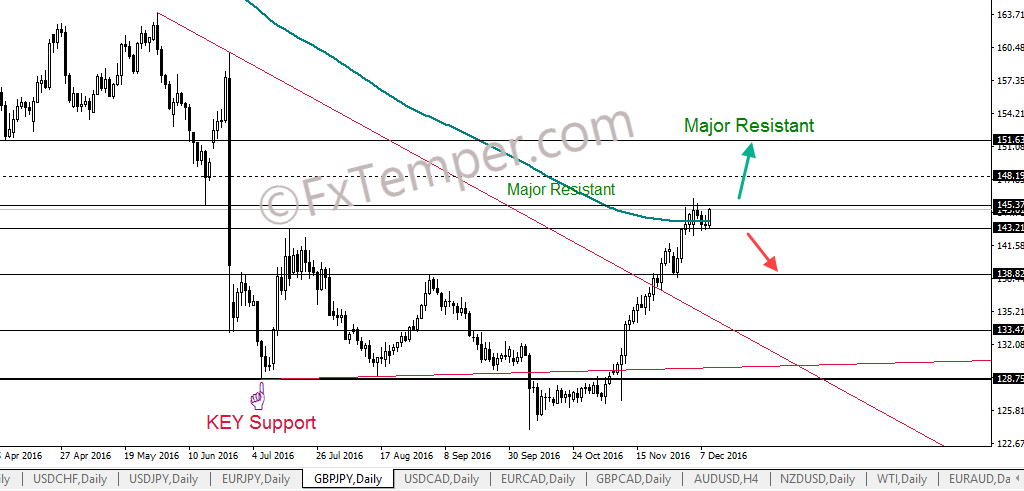

GBPJPY:

Temper: Bullish

GBPJPY hovering between two major support and resistant with lower distant.

There would be another great Long opportunity once break the resistant 145.375 to next Major Resistant 151.633. 600+ Pips

AUDUSD:

Temper: Bearish

AUDUSD made 2 H4 small falling wages and finally making an M pattern in D1 after 3 weeks breaking the major support (present resistant) .75036.

If you look closely in H4 .74445 is the H4 Major support. I will be short again once broke the H4 support and target would be till .7325 the new H4 Support. I will wait for another breakout at .73102 (new D1 support) to short till the final destination Major support .7242.

Do you want more analysis? USDJPY, EURJPY, USDCHF, GBPCHF, NZDUSD, EURNZD, USDCAD, WTI (Oil), Gold, Silver, SPX500, UK100, Nikkei225 and more. Get them at premium membership area.