Weekly Forex Analysis and Trade Setups – Jan 30th to Feb 3rd

Trump administration did everything they could in first week to mark the previous administration. President Trump used his executive power to cancel few trade deals and rest of the trade deals are in threat too!

Market is waiting for more information about his fiscal stimulus, infrastructure plan. His ‘America First’ policy would bring more inflation and FED has little choice but rate hike. Though we expect no rate hike next Wednesday (February 1). According to CME Group FOMC indicator there is only 4% chance of a rate hike. Anyway, NFP will drive the US dollar at Friday. We will be focusing on [mks_highlight color=”#eeee22″]‘Wage’[/mks_highlight] in NFP.

Let’s look at the major pairs trade ideas and their probable setups.

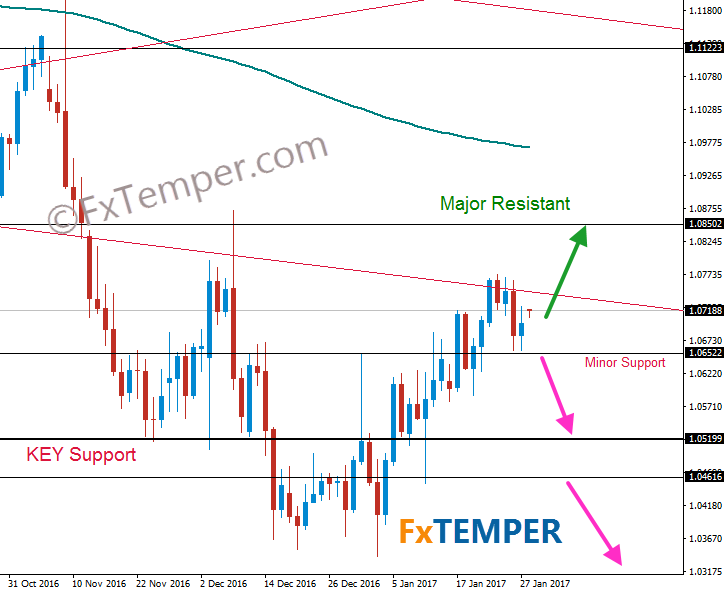

EURUSD:

Temper: Bullish

We had a bearish Doji after 5 consecutive bullish weeks from EURUSD. However, the price of EURUSD is still above the Support 1.06522 (new Support). Next Major Resistant is 1.08502 the low of Oct25,2016.

I am a Seller at EURUSD and I will be short once price break the support 1.06522. Next target would be the KEY Support 1.0520. Raising wage in H4 and upcoming NFP could be a good moment to short.

A break below 1.04616 would open door further for the new Major Support 1.0206

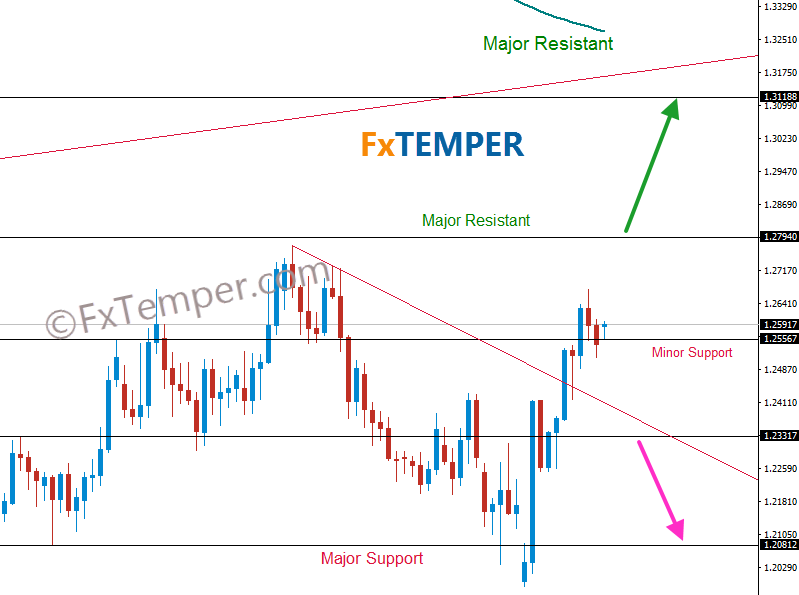

GBPUSD:

Temper: Bullish

Supreme court ruled for a soft Brexit last week which is against the view of PM Theresa May. Market took that as positive and Pound surged against other pairs.

Pound would be volatile ahead of Super Thursday. We will get Inflation report and Monetary policy from BOE. There would also be a press conference where BOE governor will answer the press.

Any surprise would create high volatility to the GBP pairs. [mks_highlight color=”#eeee22″]We suggest[/mks_highlight] you to close your position from GBP pairs before the event.

The technical price of GBPUSD is no-man’s-land position.

We will be long only if it can break the Major Resistant 1.2794 which will open door to the next Resistant 1.31188.

On the other hand, a break below 1.23317 would create opportunity to short towards 1.2080

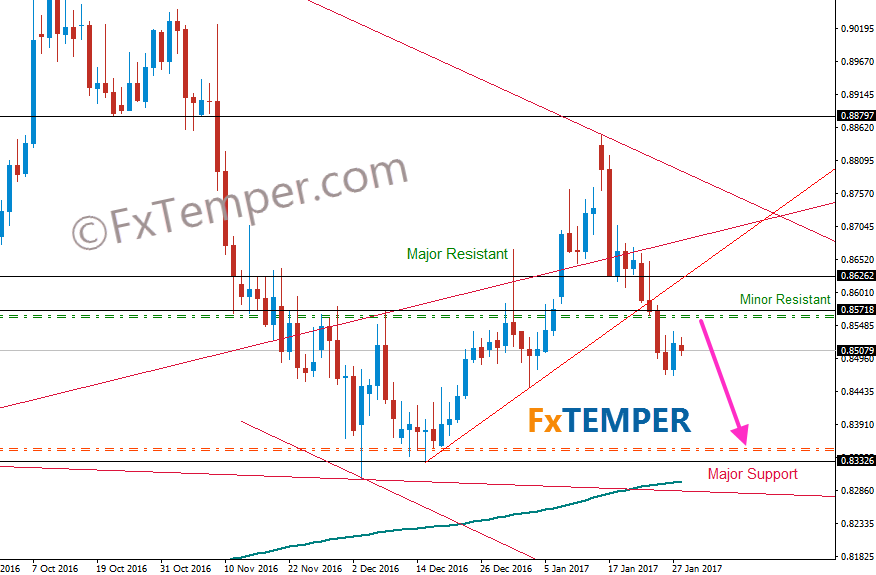

EURGBP:

Temper: Bearish

I already mentioned last week that EURGBP is in my favorite list as it is in a clear down trend. It broke the support .85718 and next Major support is .83326.

I am running my short entry since last week as you can see in the chart.

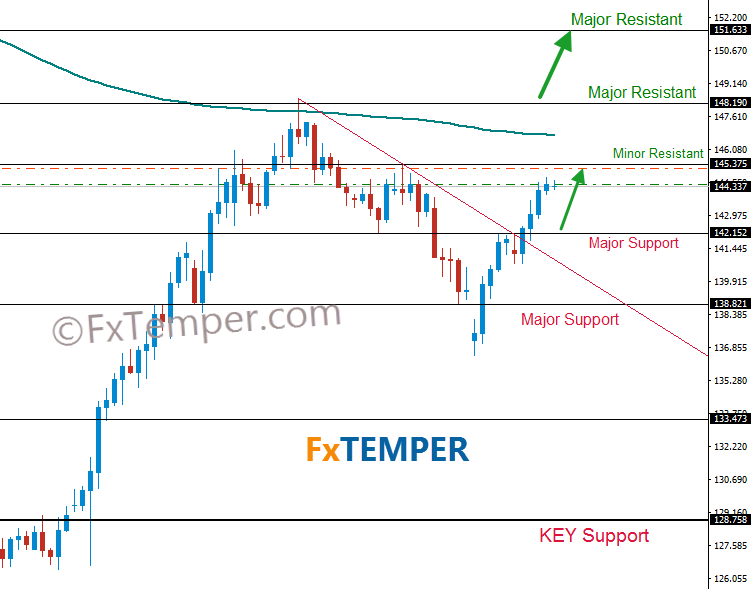

GBPJPY:

Temper: Bullish

BOJ major decision is coming tomorrow at Tuesday. Any surprise from BOJ could create high volatility to the Yen pairs. [mks_highlight color=”#eeee22″]We suggest to watch the event closely.[/mks_highlight]

We took long at GBPJPY once it broke the Resistant 142.152 (which is acting as support now). The present Major Resistant is 145.375

However, we will be only long once price break 148.19 towards next Resistant 151.633.

We won’t be taking any long position between 145.375 to 148.19 .

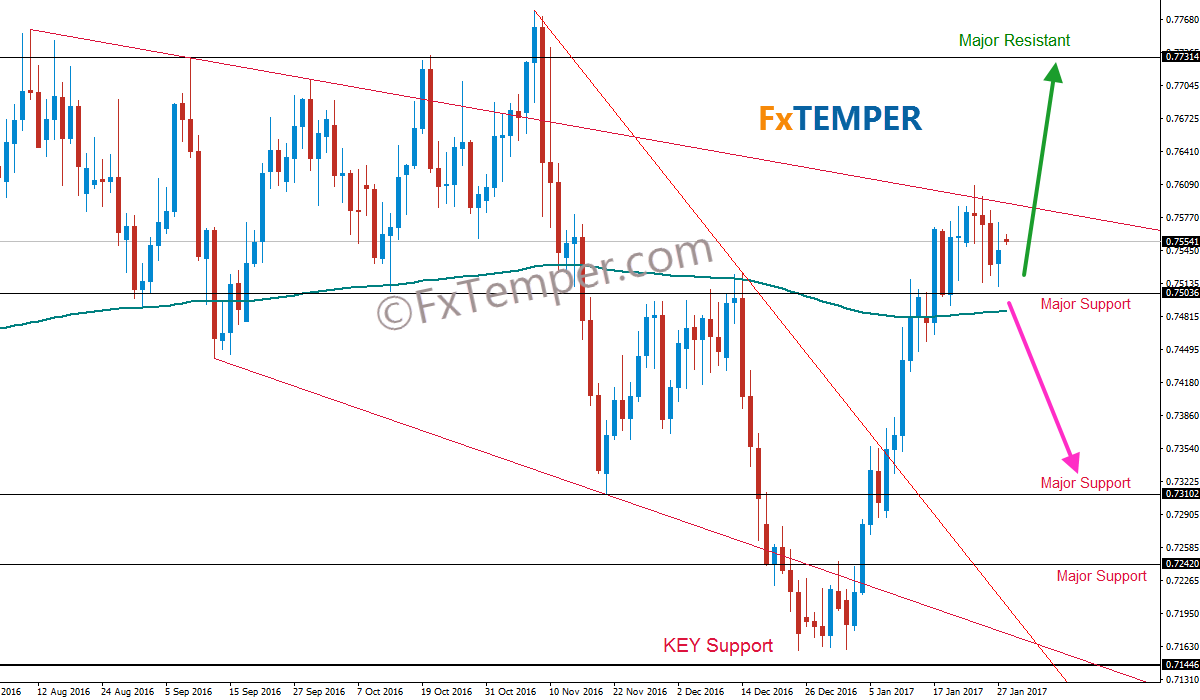

AUDUSD:

Temper: Bullish

AUDUSD is my most favorite Major pair due to best performance since last couple of months.

AUDUSD broke the Major Resistant .75036 and next Major Resistant is .77314. AUDUSD price is still below the Lower High trendline (High of Aug11,2016 and Sep08,2016).

But we already engaged with Long position as Bullish Gold and bearish Dollar index. [mks_highlight color=”#eeee22″]We suggest[/mks_highlight] you to take calculated risk and use SL. I took ¼ of the lot size comparing my regular volume size.

Do you want more analysis? USDJPY, EURJPY, USDCHF, GBPCHF, NZDUSD, EURNZD, GBPNZD, USDCAD, WTI (Oil), Gold, Silver, SPX500, UK100, Nikkei225 and more. Get them at premium membership area.