Weekly Forex Analysis and Trade Setups – February 6-10, 2017

Market is heavily anticipating on more clarity from Trump’s administration for his fiscal stimulus, infrastructure plans, tax reform and other important economic steps as he promised to the voters.

The technical perspective of ‘Dollar Index’ is in support zone (though did not touch the support price for 10 pips at last Thursday). We are expecting bullish Dollar from middle of this week or from the next week!

But more delay from Trump could create turmoil to the retail traders.

Let’s look at the trade ideas and their probable setups for this week.

(All charts from FxPro)

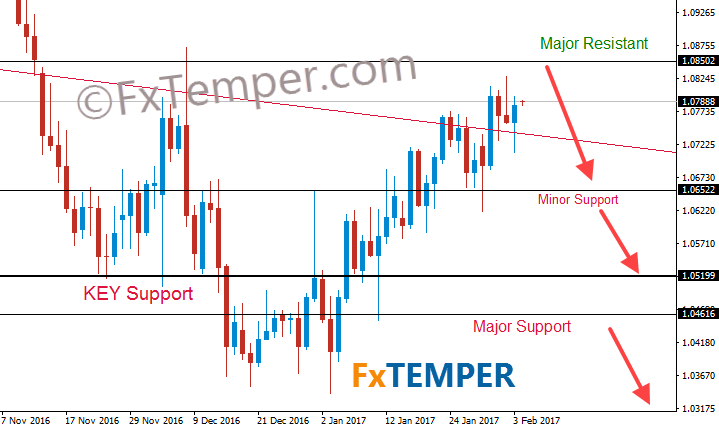

EURUSD:

Temper: Bullish

The market sentiment of EURUSD is bullish for last 7 weeks! There are number of reasons for that but from technical view we should see 1.08502 (low of Oct 25,2016) serve as resistant and 1.06522 (high of Dec30,2016) as support for now.

However, I will be only selling EURUSD if price break 1.0652. Next target would be the KEY Support 1.0520.

And a break below 1.04616 would open door to the next Major Support 1.0206!

GBPUSD:

Temper: Bullish

We believe ‘House of Commons’ will pass the [mks_highlight color=”#eeee22″]Article 50[/mks_highlight] bill without more complication at this final stage.

Our technical view remains same as last week! We will be long only if price can break the Major Resistant 1.2794 which will open door to the next resistant 1.31188.

On the other hand, a break below 1.23317 would create opportunity to short towards 1.20.

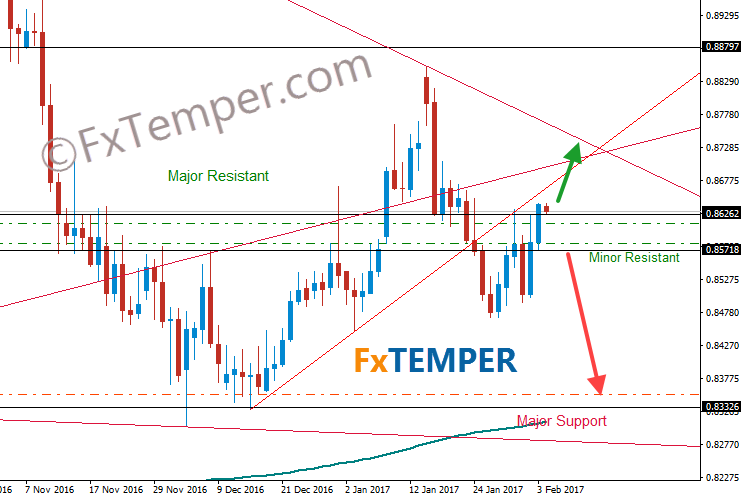

EURGBP:

Temper: Bearish

A bad NFP data pushed the EURGBP above the resistant .86262, however the price is still below the higher low trend line. A daily close of today above the candle closing of last Friday .86413 would be a breakout of .86262 and next minor resistant would be .87629 the high of January 10,2017.

We remain bearish at EURGBP and a breakout of present support .8571 would open door towards next major support .83326 .

GBPJPY:

Temper: Bearish

GBPJPY remains bearish due to bullish Yen.

We will be long once price break the price major resistant 142.152 towards another major resistant is 145.375 .

However, we do not suggest to add short towards support 138.82 as price is still above the Lower High trendline . But you are good to short if price break the major support 138.82 .

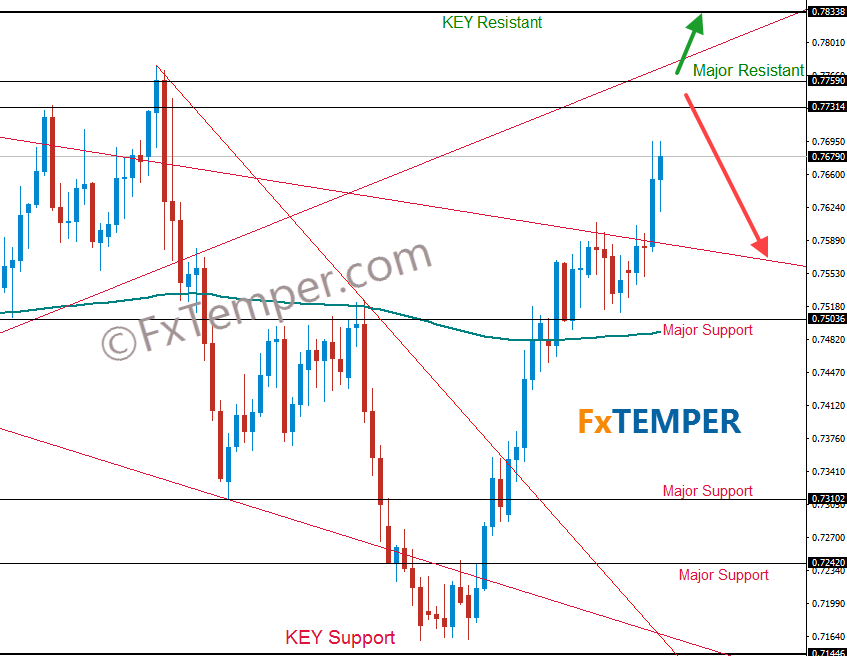

AUDUSD:

Temper: Bullish

We closed our Long positions from AUDUSD at last Thursday before NFP (with 100+ pips in profit). And we expect no major change towards RBA rates decision at late Monday!

All of my other price action analyst friends took short last week while we run Long! The primary reason was they don’t know identify the exact support. According to our core price action strategy AUDUSD was above the support (.75036) and was finding a resistant.

Anyway, we have reasonable doubts that [mks_highlight color=”#eeee22″]AUDUSD will not be bullish for longer[/mks_highlight] periods as it is facing a significant demand zone and major resistant at .7759 (the high of August 11,2016) and .77314.

The price .7759 will serve as a Double Top and most significant multi-year Higher Low trendline also be at that zone!

We will be taking short once we get bearish price action signal from the resistant .7759

WTI (Oil):

Temper: Neutral

I am adding WTI with free weekly trade setups as getting many requests for it.

WTI is in above the resistant but below the Higher low (low of Nov14 and Nov 29 of 2016) and Higher High (high of Oct 10 and 19 of 2016) trendline. Which is also a significant 76.4% Fibo retracement level.

However, a break of major resistant $55.27 (high of Dec 12,2016) would open door towards next resistant $58.55

But, a breakout of major support $52.00 (high of Oct 10,2016) would open door to the next major support $49.40 (high of Aug19,2016) which is also 61.8% retracement of fibo (high of 2015 to low of 2016)!

Do you want more analysis? USDJPY, EURJPY, USDCHF, GBPCHF, NZDUSD, EURNZD, GBPNZD, USDCAD, Gold, Silver, SPX500, UK100, Nikkei225 and more. Get them at premium membership area.